Background

In the past decade, FinTech has become the megatrend for all countries. FinTech innovations have globally transformed financial services and aiming to achieve inclusive finance. The Financial Supervisory Commission (FSC) has been actively promoting RegTech in recent years, and its focal points of administration in 2020 include assisting in the financial market’s development and addressing consumers’ needs for financial services. The FSC continues to build and improve the financial supervision system of Taiwan, and to enhance the international competitiveness of financial institutions. To accelerate the maturity of digital supervision and explore future digital risks, the FSC invited the Taiwan Depository & Clearing Corporation (TDCC), Joint Credit Information Center (JCIC), and associated units to jointly discuss the RegTech development in Taiwan, and also integrated the resources of financial institutions to introduce the latest technologies and systems.

Taiwan RegTech Challenge (TRC) 2020 is supported by FSC, Taiwan supervisory authorities, and funded by TDCC, hosted by TDCC and FinTechSpace. TRC 2020 is a public and private partnership event to accelerate the digital regulatory journey in Taiwan. TRC 2020 is looking for high potential, reliable and advanced tech/RegTech-based solutions around the world.

Objectives

Aligned with the FSC’s Open Banking promotion, there are 4 objectives for TRC 2020:

- identifying feasible methods to accelerate the implementation of RegTech;

- building a consensus through the digital supervision integration across industry and government;

- connecting to the international RegTech network;

- aggregating RegTech capabilities to serve as the competent authority’s basis for implementing digital supervision or legal adjustment in the future.

TRC 2020 Participation Guidelines

TRC 2020 participants will be assessed on documents submitted and final 30 will be further assessed on demo and presentation slides in the semi-final and final.

Challenge Topics

-

- eKYC:Primary and premium information process and collection for KYC purposes like electronic identification, strong authentication, etrust services (eIDAS), identity verification, etc.

- Monitoring, Surveillance & Data Sharing

- Dynamic and automatic real-time data sharing for supervisors and regulators for surveillance relating to operational risk, market risk, sanction risk, etc.

- Timely incident related information collection and analysis

- Data sharing in compliance

- Financial Crime Compliance & Fraud Detection

- Suspicious transactions, accounts and behavior detection for money laundering, financing of terrorism, employee misconduct, etc.

- Fraud detection

- Beneficial ownership identification

How to Apply

Participants: Open to startups, researchers, financial institutes and any team built across different organizations.

Contact: fintechspace@iii.org.tw

TRC 2020 Awards

TRC Awards (Final 3 and 2 runner-ups)

- FinTechSpace resources

- Rent free for a hot desk in FintechSpace for 12 (Final 3) / 6 months (runner-ups)

- FinTechSpace mentoring:

- Regulatory Checkup:Free 1 hour Baker McKenzie regulatory checkup

- Information security check

- Regulatory clinic

- Free AWS cloud space: FintechSpace-AWS JIB

- 2021 FinTech Taipei:

- Free 2 booths for Final 3 and 1 booth for 2 runner-ups

- One Demo session

- Matching: business and VC matching

- eKYC topic only:

- TWCA will issue an EAPS report for the award-winning proposals.

- After residing at FinTechSpace, the winning team can launch its API on eKYC digital sandbox.

PoC Prize with Local Partners

AWS, Bank SinoPac, Cathay United Bank, Far Eastern International Bank, LINE Bank, Mega International Commercial Bank, Microsoft, Next Bank, Taishin International Bank, TDCC, Yuanta Securities

Milestones

*Taiwan RegTech Challenge 2020 – Important notice: In response to the international COVID-19 epidemic, TRC 2020 will extend the application deadline to 2020.10.21 PM 5:00 (GMT+8).

- 2020.08.17-2020.10.16 Call for solutions. TRC 2020 will extend the application deadline to 2020.10.21 PM 5:00 (GMT+8)

- 2020.11.06 Semi-finalist announcement

- 2020.11.16 Taiwan RegTech Challenge 2020 Data Partner and Mentor Matching Workshop has been successfully held. All matching workshop participating teams will receive an email notification on their matching results by this Friday (2020.11.20).

- 2020.12.18 Taiwan Regtech Challenge 2020 Semi-Final has been held. We will e-mail the result to each team by 2020.12.23.

- 2020.12.23-2021.01.20 One-on-one evaluation

- 2021.01.28-2021.01.29 Final and TRC 2020 award ceremony

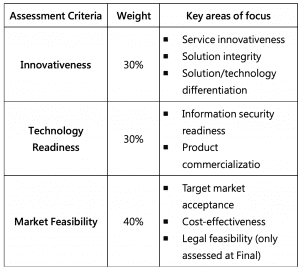

Assessment

Resources

Data Partners:

| Data Partners | ||

| No. | Data Partner | Topic Related |

| 1. | Bearing Point | 2.1 Dynamic and automatic real-time data sharing for supervision and regulation for surveillance relating to operational risk, market risk, sanction risk, etc.

2.2 Timely incident related information collection and analysis 2.3 Data sharing in compliance |

| 2. | Dun & Bradstreet Taiwan | 2.1 Dynamic and automatic real-time data sharing for supervision and regulation for surveillance relating to operational risk, market risk, sanction risk, etc.

2.2 Timely incident related information collection and analysis 2.3 Data sharing in compliance |

| 3. | Dow Jones | 2.3 Data sharing in compliance |

| 4. | SinoPac Securities Corporation(11/6 Updated) | 2.3 Data sharing in compliance |

| 5. | Taiwan Economic Journal(TEJ) | All three topics |

| 6. | Taiwan Futures Exchange | All three topics |

Partners’ Datasets:

| BearingPoint Software Solutions Pte Ltd | Download |

| Dun & Bradstreet Taiwan(Sept. 1 update) | Download |

| Dow Jones | Download |

| SinoPac Securities Corporation | Download |

| Taiwan Economic Journal (TEJ) | Download |

| Taiwan Futures Exchange(Sept. 3 update) | Download |

Mentors:

| Mentors | ||

| No. | Mentor | Topic Concerned |

| 1. | AWS | Cloud Environment and Tools |

| 2. | Cathay Financial Holdings | 1.1 eKYC

2.3 Data sharing in compliance 3.1 Suspicious transactions, accounts and behavior detection for money laundering, financing of terrorism, employee misconduct 3.2 Fraud detection 3.3 Beneficial ownership identification |

| 3. | Fubon Financial Holdings | 3.3 Beneficial ownership identification (D&B only) |

| 4. | KGI Bank | 3. Financial Crime Compliance & Fraud Detection |

| 5. | Mega Bank | 3.1 Suspicious transactions, accounts and behavior detection for money laundering, financing of terrorism, employee misconduct |

| 6. | Microsoft | AI working environment |

| 7. | Next Bank | 1.1 eKYC

2.1 Dynamic and automatic real-time data sharing for supervision and regulation for surveillance relating to operational risk, market risk, sanction risk, etc. 2.2 Timely incident related information collection and analysis 3.1 Suspicious transactions, accounts and behavior detection for money laundering, financing of terrorism, employee misconduct 3.2 Fraud detection |

| 8. | Taiwan Business Bank | 1.1 eKYC |

| 9. | Taipei Fubon Bank | 2. Monitoring, Surveillance & Data Sharing

3. Financial Crime Compliance & Fraud Detection |

| 10. | Taishin International Bank | 3. Financial Crime Compliance & Fraud Detection |

| 11. | Yuanta Securities | All three topics |

Partners/